st louis county mn sales tax

The current total local sales tax rate in Saint Louis Park MN is 7525. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax.

The December 2020 total local sales tax rate was also 7525.

. Below are some tools to help you find property information that you may be looking for. Your payment must be postmarked on or before the due date or penalties will apply. What is the sales tax rate in St Louis Park Minnesota.

Tax-forfeited land managed and offered for sale by St. What is the sales tax rate in St Louis County. Minnesota has a 6875 sales tax and St Louis County collects an.

All contractors or sub-contractors must. Louis County local sales taxesThe local sales tax consists of a. Minnesota has 231 cities counties and special districts that collect a local sales tax in addition to the Minnesota state sales taxClick any locality for a full breakdown of local property taxes.

Louis County Minnesota sales tax is 738 consisting of 688 Minnesota state sales tax and 050 St. The current total local sales tax rate in Saint Louis County MN is 7375. The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects.

The December 2020 total local sales tax rate was also 7375. This is the total of state county and city sales tax. See all other payment options below for associated.

Louis County Greater MN Transportation Sales and Use Tax Transportation Improvement Plan adopted December 2 2014 County Board File No. Saint Louis County in Minnesota has a tax rate of 738 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax. The minimum combined 2022 sales tax rate for St Louis Park Minnesota is.

Minnesota Statute Chapter 282 gives the County Board the County Auditor and the Land Minerals Department authority over the management and sale of tax forfeited lands. This is the total of state and county sales tax rates. This 05 percent transit tax.

Information on timber sales on state tax forfeited land. Louis County is land that has forfeited to and is now owned by the State of Minnesota for the non-payment. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 773 in St.

The minimum combined 2022 sales tax rate for St Louis County Minnesota is. The Saint Louis County Minnesota Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Saint Louis County Minnesota in the USA using average. See details for 3132 Nevada Avenue S Saint Louis Park MN 55426 Single Family 3 bed 3 bath 1992 sq ft 430000 MLS 6268818.

Saint Louis County Sales Tax Rates for 2022. Sales Tax Table For St. Saint Louis County MN currently has 285 tax liens available as of October 2.

The total sales tax rate in any given location can be broken down into state county city and special district rates. Welcome home to this updated beauty. Pay by E-Check for FREE online with Paymentus.

St Louis County Land Explorer Arrowhead Bowhunters Alliance

Isd No 283 St Louis Park Public Schools Ehlers Inc

Employment Opportunities Sorted By Job Title Ascending City Of Duluth Career Pages

St Louis County Eyes 4 39 Tax Levy Increase Duluth News Tribune News Weather And Sports From Duluth Minnesota

Tax Forfeited Land Sale Includes 18 Houses Former Clover Valley School Site

St Louis County Waives Fees For Online Property Tax Payments

Saint Louis County Mn Property Data Real Estate Comps Statistics Reports

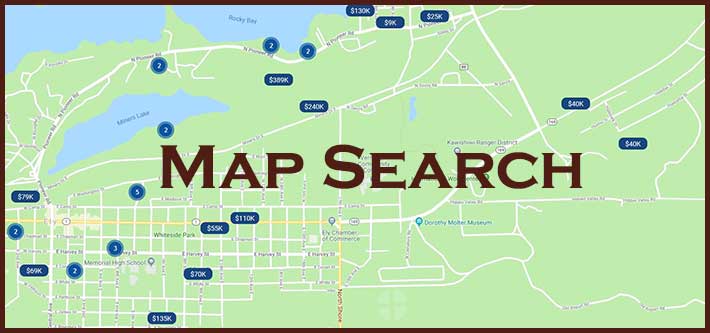

Ely Mn Real Estate Sales From Your Full Service Realtor Wildwoods Land Company

St Louis County Tax Fight Heats Up As Region Seeks Economic Unity Nextstl

St Louis County Arrest Court And Public Records

Cook County Increases Its Sales Tax By One Percentage Point The Civic Federation

The Association For Nonsmokers Minnesotaflavored Tobacco The Association For Nonsmokers Minnesota

Saint Louis County Mn Real Estate Saint Louis County Mn Homes For Sale Zillow